You may have seen the term tax deferred while reading about investments, retirement plans, or savings accounts and felt confused. Many people think tax-deferred means tax-free, but that’s not true.

Understanding the tax deferred meaning is important because it affects how much money you keep today and how much you may owe later. Updated for 2026, this guide explains tax-deferred income in clear, beginner-friendly language with practical examples.

What Does Tax Deferred Mean?

Tax deferred means you do not pay taxes right now, but you will pay them later in the future.

In simple words:

Tax deferred means taxes are postponed, not canceled.

You are delaying the tax payment until a later time, often when you withdraw money.

How Tax Deferral Works

Tax deferral works by shifting the tax obligation to the future.

Here’s the basic process:

You earn or invest money

Taxes are not taken immediately

The money grows over time

You pay taxes when you withdraw or use the money

This delay can allow your money to grow faster.

Tax Deferred vs Tax Free: Key Difference

Many people confuse these two terms.

Tax deferred: Taxes are paid later

Tax free: Taxes are never paid

Example:

A retirement account may be tax deferred, meaning withdrawals are taxed later.

Some accounts are tax free, meaning withdrawals are not taxed at all.

Understanding this difference prevents costly mistakes.

Common Examples of Tax-Deferred Accounts

Tax-deferred options are common in financial planning.

Examples include:

Retirement savings plans

Pension plans

Certain investment accounts

Employer-sponsored savings programs

In these cases, taxes are delayed until retirement or withdrawal.

Tax Deferred Meaning in Investments

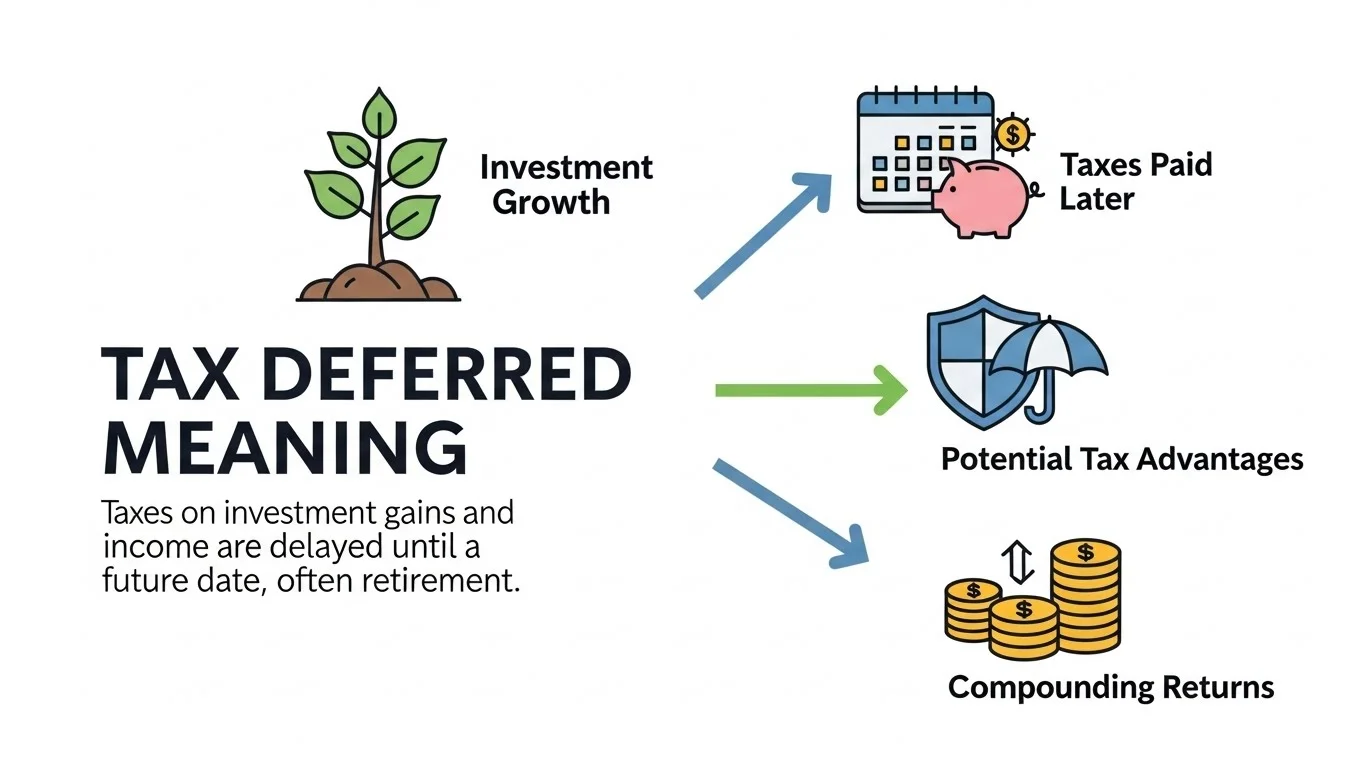

In investing, tax deferred allows earnings to grow without immediate tax deductions.

Benefits include:

More money staying invested

Compounding growth

Potentially lower tax rate in the future

However, taxes will apply when money is withdrawn.

Tax Deferred Meaning in Retirement Planning

Tax deferral is especially popular in retirement planning.

Why people choose it:

Income may be lower after retirement

Lower tax rate later

Long-term growth benefits

This strategy helps manage taxes across different life stages.

Advantages of Tax Deferred Income

Tax deferral offers several benefits.

Key advantages:

Immediate tax savings

Faster growth potential

Better cash flow today

Useful for long-term planning

For many people, delaying taxes makes financial sense.

Disadvantages of Tax Deferred Income

Tax deferral also has downsides.

Possible drawbacks:

Taxes are unavoidable later

Future tax rates may be higher

Required withdrawals may apply

Less flexibility with withdrawals

It’s important to plan ahead.

When Paying Taxes Later Can Be Helpful

Tax deferral is often helpful when:

You expect lower income in the future

You are saving for retirement

You want long-term investment growth

It may not be ideal for short-term savings.

Common Mistakes and Misunderstandings

People often misunderstand tax deferred because:

They think it means tax-free

They forget future tax obligations

They ignore withdrawal rules

They underestimate future tax rates

Clear understanding helps avoid surprises.

Tax Deferred Meaning in Simple Everyday Terms

Think of tax deferral like borrowing time.

You’re saying:

“I’ll pay taxes later, not today.”

The money works for you now, but the tax bill eventually arrives.

Related Financial Terms

Terms often related to tax deferred include:

Taxable income

Capital gains

Tax-free income

Retirement savings

Withdrawals

Learning these terms makes financial decisions easier.

FAQs

What does tax deferred mean in simple words?

It means you delay paying taxes until a later time.

Is tax deferred the same as tax free?

No. Tax deferred means you pay taxes later; tax free means you don’t pay them at all.

Why do people choose tax-deferred accounts?

To save taxes now and allow money to grow over time.

When do you pay taxes on tax-deferred money?

Usually when you withdraw or use the money.

Is tax deferral good for everyone?

Not always. It depends on income, goals, and future tax rates.

Conclusion

The tax deferred meaning is simple once you break it down: taxes are postponed, not avoided. This strategy can help money grow and ease financial pressure today, but it requires planning for future tax payments.

Knowing how tax deferral works allows you to make smarter decisions about savings, investments, and retirement.